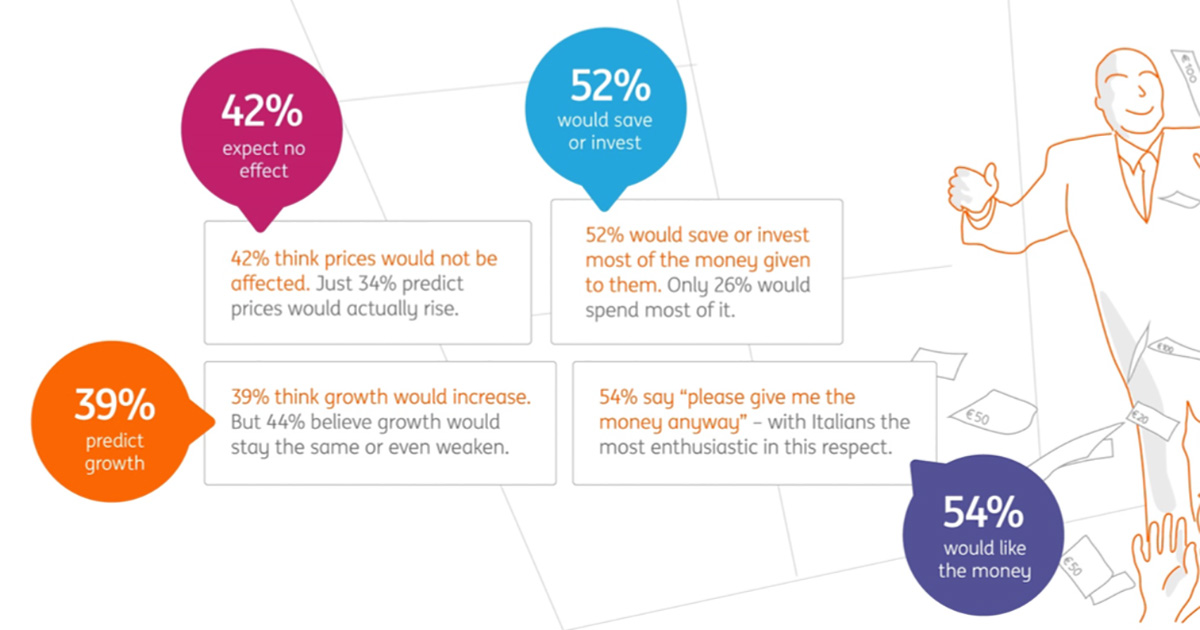

Recent survey shows that a broad majority (54%) of the European population would support a “helicopter money” from the European Central Bank while only 14% would be against.

In case this wasn’t already obvious already: most Europeans would like to receive money directly from the ECB. This idea, which is most known under the nickname ‘helicopter money’ is gaining traction since the CB engaged in quantitative easing back in 2015.

A recent survey carried out by the polling company Ipsos for the Dutch bank ING shows that no less than 54% of the respondents think ‘helicopter money” would be a good idea, while only 14% are against.

This survey was conducted by polling company Ipsos between 3 June and 24 June 2016 using internet-based polling of a sample of nearly 12,000 people across 12 countries. It is the largest survey we have come across so far testing the level of support for the concept.

Helicopter money would effectively raise demand

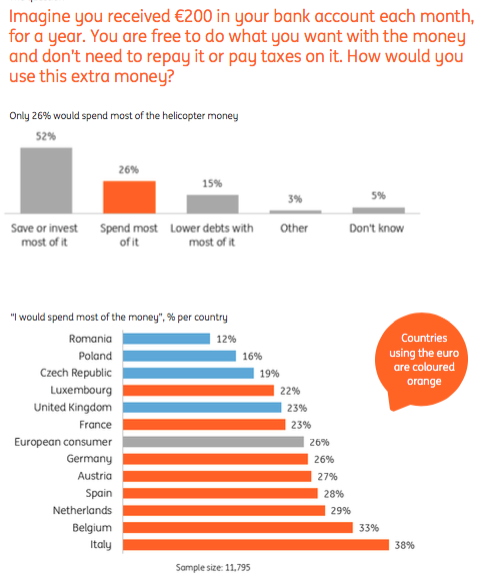

The survey also tests how people would spend the money, under the assumption that they would receive 200€ per month for a year. According to the survey, “26% would spend most of the helicopter money” right away. The Dutch bank goes on to claim that the economic boost from helicopter money would be “doubtful”.

This interpretation seems unduly gloomy: by ING’s own calculations, which assume that only 26% of all the helicopter money distributed is immediately spent, the extra spending would provide an immediate boost of 2% to euro area GDP, before taking into account second order effects.

And if people spend more than 26% of the total money, the effect would be higher still. For example when Australia issued a “tax bonus” in 2009, around 40% of households spent it all straight away. An increase of 2% or more of GDP can hardly be called a “doubtful” benefit.

A similar survey conducted by the hedge fund Astellon Partners of 2,500 people in the four biggest eurozone countries presents its results in a much more positive way. The Astellon survey allowed people to choose more than one option for how they would use the money if they received 300€ per month, from a list including saving, spending, working less, and debt reduction.

The average respondent selected two uses, and on average one of these was spending. In Germany, for example, 100% of people said they would increase their spending, among other things, regardless of their income level. Moreover, the ING survey outlines that citizens in eurozone countries clearly show a higher spending behaviour than citizens in the non-eurozone countries included in the sample. This makes the case for helicopter money especially relevant in the eurozone. Helicopter money could boost GDP by around 2%, the ING survey finds.

Debt payoffs and savings are future spending too

That some people would not spend most of the money immediately is not necessarily a bad thing. When people pay off their personal debts (both surveys suggest between 15 and 25% of people would use the money to reduce debts), this means they are likely to increase spending in future because they would have more disposable income (and more ability to take on new debt).

And when people save, for example to buy a car or put money into a pension, the money will normally be spent in the future. This suggests that nearly all the money created is likely to boost demand to some degree at some stage.

Helicopter money entails very little risk

Ultimately, the surveys demonstrate that the risks entailed by doing helicopter money are quite minimal, compared with some of the alternatives being discussed. ING found that 70% of the respondents believe the economic growth would be equal or stronger if the ECB operated such a measure during 12 months. Only 13% of the respondents thought the economy would perform worse.

The bank’s survey also acknowledges that helicopter money would be superior to the current quantitative easing approach, which is anti-redistributive. “The large-scale buying of government bonds leads to price increases in assets such as shares and real estate. Wealthier people holding those assets gain directly. Small savers gain only indirectly, through trickle-down effects,” the ING survey noted, echoing earlier central bank research.

Astellon’s survey found that another alternative, charging negative interest rates on deposits, would simply cause people to withdraw their bank deposits and put them elsewhere, creating dangerous bank runs and almost no increase in consumption.

Overall, those surveys provide greater evidence that helicopter money is by far more likely to work to boost the economy than the current policy mix in the Eurozone, and some of the alternatives being discussed.

Source: http://www.positivemoney.eu/2016/10/poll-helicopter-money/