Er is veel te veel geld wereldwijd. Mensen kopen overal huizen. De grote vraag drijft de prijzen op. Betaalbaar wonen is een wereldwijd probleem. Huizen zijn een massaproduct – hoe kan het dat velen ze niet kunnen betalen? Dat betekent dat wanneer de bubbel in de VS barst de wereldwijde bubbel ook gaat barsten. Het goede nieuws: de prijzencrisis in rijke landen verdwijnt.

Het levensonderhoud wordt goedkoper. Maar de waarde van je eigendommen daalt. Het leven wordt makkelijker, maar je bent minder rijk dan je dacht.

Het Amerikaanse idee van winnen

Het Amerikaanse idee van winnen is dat je een god creëert. Die god woont in San Francisco en werkt voor Amerika. Er is nu sprake van een geldbubbel, die op niets gebaseerd is. Dat gaat ophouden.

China en de praktijkgerichte AI

In China was AI gebaseerd op reële toepassingen in de fysieke wereld. Het ging vooral om het maken van dingen. Mensen willen graag technologie die de productie verbetert. De eerste AI-toepassing was in de mijnbouw. De VS ging meer in de richting van grote taalmodellen.

Hallo, ChatGPT, hoe gaat het?

– Fantastisch, leuk dat je dat vraagt.

En met jou?

– Goed.

Wat is er?

– Mijn vriend heeft slaapproblemen.

Kun je hem een verhaaltje vertellen over robots en liefde?

– Een verhaaltje over robots en liefde? Dat gaat wel lukken.

De menselijke geest vindt dat aantrekkelijk. Of het geld oplevert Niemand verdient eraan. Maar de Chinezen dachten dat ze een achterstand hadden opgelopen. Die wilden ze inhalen. Daarom ontstond DeepSeek.

DeepSeek en de uitdaging voor NVIDIA

Dit is een grote uitdaging voor de overmacht van NVIDIA en hun chips.

Als je AI kunt produceren zonder die geavanceerde chips is dat revolutionair. Kijk, NVIDIA is 11,5 procent gezakt – het grootste verlies aller tijden. DeepSeek is nummer 1 in de App Store. DeepSeek was niet voorzien.

Een stel mensen dat niet naar een chique universiteit was geweest en niet voor beroemde tech-bedrijven werkten hadden samen, met weinig geld, wel iets gemaakt. Dat was een schok voor de wereld en voor de Chinese regering.

DeepSeek in de echte wereld

DeepSeek is een chatbot. Het kan ook wat OpenAI kan, maar Chinezen willen altijd iets maken dat bruikbaar is in de echte wereld. Het is geïntegreerd in elektrische voertuigen. Zo kan de bestuurder via DeepSeek met de auto communiceren. DeepSeek praat ook als een gewoon mens. Zo is het nu bruikbaar in de echte wereld.

Ik heb me nog nooit zo nederig gevoeld. 70% van alle elektrische auto’s worden in China gemaakt en hebben een superieure technologie. Je stapt in, je mobieltje maakt automatisch verbinding met de auto.

Je hebt een AI-partner waarmee je kunt praten – de Chinese ChatGPT.

Je kunt automatisch betalen, bioscoopkaartjes kopen.

Via gezichtsherkenning weet hij wie in welke stoel zit.

Waarom zit dat niet in auto’s van Ford?

Google en Apple wilden niet in de auto-industrie. We moeten wereldwijd concurreren met China, niet alleen met elektrische auto’s. Als we verliezen, heeft Ford geen toekomst.

De betekenis van AI

Dat is het belangrijkste aspect van AI: Hoe kan het mensen bijstaan in de echte wereld?

In dat opzicht doet China het vrij goed en ligt het op veel gebieden waarschijnlijk voorop. Ik wil de virtuele wereld niet kleineren. Veel mensen brengen daar veel tijd door. Ze verwarren het al gauw met de echte wereld. Als ze het over AI hebben, zeggen ze: “Wauw, AI kan een plaatje maken.” Veel mensen hebben daar plezier van. Dat is ook iets waard. Maar Chinezen zijn praktischer: “Hoe kun je vandaag een machine productiever maken?”

Amerika versus China

In de race om AI… Wie wint er? Amerika of China?

Als het Amerika is, hoe ver ligt China achter ons? En wat doen we om ervoor te zorgen dat Amerika op voorsprong blijft?

Meneer Altman, u eerst.

Amerikaanse AI-modellen van OpenAI en Google zijn de beste ter wereld.

De Amerikaanse taal zit vol met sportmetaforen uit honkbal en football. Alles is een wedstrijd. In de VS hebben ze een droom: “We krijgen superintelligente AI.” Het Amerikaanse idee van winnen is dat je een god creëert. Die god woont in San Francisco en werkt voor Amerika.

Bij de Chinese open source-benadering gaat het niet om winnen.

Hoe win je als alles gedeeld wordt? DeepSeek is open source.

Iedereen kan het op zijn eigen computer downloaden .en het is veel goedkoper dan OpenAI. Dat is omdat DeepSeek tien keer zo efficiënt is als OpenAI.

Het gebruikt veel minder energie, dus het is veel goedkoper in het gebruik.

De wereldmarkt en het Zuiden

De belangrijkste factor bij het bepalen of de VS of China deze race wint is welke technologie het meest gebruikt wordt in de rest van de wereld. Het is een wereldwijde markt. Die wordt bepaald, zoals altijd in de technologie, door netwerkeffecten. 18% van de wereldbevolking woont in China 4% in de VS, en 78% woont ergens anders. In het mondiale Zuiden, waar zeven miljard mensen wonen is de Amerikaanse benadering niet erg werkbaar.Het Amerikaanse bedrijfsmodel is te duur. Ze investeren honderden miljarden en verwachten dat de gebruikers meer betalen zodat ze meer kunnen verdienen.

China werkt met lage prijzen – alles wat China maakt is laaggeprijsd. En China probeert net zulke goede producten te maken als het Westen.

Het wordt dus onweerstaanbaar voor opkomende economieën waar mensen weinig geld hebben. Daarom denk ik dat het Westen niet alleen wat betreft AI, maar ook op veel andere gebieden achter een muur van hoge kosten zal leven. In het komende decennium zal het mondiale Zuiden geïntegreerd raken terwijl het mondiale Noorden achter een muur blijft zitten.

Geld zonder betekenis

Wat is het verschil tussen de financiering van de AI-industrie in de VS en hoe dat in China gaat?

In de VS heeft geld geen enkele betekenis. Er is zo enorm veel geld. Een bedrijf is zomaar 1 biljoen waard. OpenAI krijgt 100 miljard dollar om te experimenteren. OpenAI maakt geen winst, maar is al honderden miljarden waard. Geld betekent iets heel anders in de VS. Dat stamt nog uit 2008, toen de VS aan kwantitatieve geldverruiming ging doen. 200 miljard is een begin.

De balans van de centrale banken begon met 900 miljard dollar.

Ze voegden 4 biljoen daaraan toe.

“Geniet van je Thanksgiving-kalkoen. Fijne vakantie.”

Toen kwam de pandemie. Ze verdubbelden de geldverruiming, weer 4 biljoen dollar. Mensen vreesden voor hun leven, maar de aandelen gingen door het dak. De gevolgen van het beleid van de centrale bank reiken ver. Ze hebben de economie verstoord. Iedereen speelt met geld, maar niet veel mensen doen nuttig werk.

De illusie van waarde

Als je een Amerikaan vraagt wat hij voor de kost doet: Niet veel mensen blijken dan iets nuttigs te doen. Iedereen is consultant, advocaat of sociaal activist.

Maar iedereen wordt goed betaald.

Zoiets zou in China niet kunnen. Iedereen moet hard werken, voor weinig geld.

De VS is een sprookjesland. Ik denk dat dat binnenkort problemen gaat opleveren.

De AI-bubbel

AI lijkt op de internetzeepbel uit 2000. Mensen geven geld zodra ze AI horen.

Iedereen met een PowerPoint kan miljarden ophalen. Wat doet een AI-bedrijf? Ze kopen chips. NVIDIA noemt zichzelf een AI-bedrijf – ze produceren chips.

Dat is geen AI. Het laat het Taiwanese bedrijf TSMC voor een dollar de chip maken. Dan verkopen ze die voor 10 dollar. Die winst wordt 100 maal vergroot, en het bedrijf is dan 3 biljoen waard. Het is geen AI-bedrijf, het is een chip-ontwerper.

Het vliegwiel van geld

We bouwen AI-bedrijven. “Dit is de xAI Colossus, dit is Stargate.” Daar zitten computersystemen van 40 tot 50 miljard dollar in. Mensen bouwen deze fabrieken omdat… jullie weten het antwoord:

We bouwen AI-bedrijven. “Dit is de xAI Colossus, dit is Stargate.” Daar zitten computersystemen van 40 tot 50 miljard dollar in. Mensen bouwen deze fabrieken omdat… jullie weten het antwoord:

Hoe meer je koopt, hoe meer je verdient.

Toen DeepSeek uitkwam, stortte het aandeel NVIDIA in.

Maar het aandeel heeft zich hersteld – er is niks veranderd. NVIDIA bestaat nog. Er zijn niet zoveel krachtige chips meer nodig.

Waarom is het aandeel dan weer gestegen? Omdat al die zogenaamde ondernemers bezig zijn geld op te halen. Ze hebben een start-up op basis van een nieuw idee om met die chips een ander AI-model te trainen. Het geld van de start-ups is wat NVIDIA verdient. De winst van NVIDIA zijn de investeringen van anderen.

De bubbel als droom

Het is allemaal gebaseerd op een droom. Betalen al die investeringen zichzelf terug? Dat kan de investeerders niet schelen. “Het hoeft alleen nog maar een jaar een hype te zijn… dan stap ik uit en ben ik rijk.” Dat is zo cynisch. – Dat gebeurt er nu.

De Chinese investeerder

Ik heb deze app zelf geïnstalleerd. Je ziet alle bedrijven.

Dit is Northward Capital. Dat gaat omhoog. Ik richt me op consumptiegoederen, zorg en big tech. Volg die drie sectoren.

Kijk uit met Pianzaihuang. Spreid je investeringen.

Er zijn ook veel Chinezen die in de VS investeren. Chinezen zijn dol op bubbels.

Als je zegt: “Dat is een bubbel.” – Dan gaan ze ervoor. Er is zoveel Chinees geld in de Amerikaanse bubbel gepompt. Ik ben begonnen met drie warrants.

Nu is het een paar miljoen waard. De laatste tijd maak ik elke dag winst.

Wat als de bubbel barst?

Het succes van DeepSeek zal dus de aandelenbubbel in de VS doorprikken?

Bubbels komen altijd voor. De basis ligt in monetair beleid – als er te veel geld is. Iedereen praat over AI: dat is dan de bubbel. Het kan nuttig zijn, maar het blijft een bubbel. Het gaat erom wanneer die barst.

In de VS is het overheidstekort enorm. Elke 100 dagen groeit dat met een biljoen dollar. 60 procent van de mensen komt maar net rond. 20 procent doet boodschappen op krediet – ‘koop nu, betaal later’. Toch stort het niet in, want Wall Street houdt het overeind. Drie vermogensbeheerders – BlackRock, State Street en Vanguard – beheersen 80% van de kapitaalmarkt. Ze lunchen elke week en bepalen de markt. Ze vinden een manier om de bubbel te laten voortbestaan: consolidatie.

De veerkrachtige bubbel

De bubbel in de VS is erg veerkrachtig geworden door structurele oorzaken.

Het is moeilijk om dat te doorbreken.

Barst de bubbel nooit?

Daar zijn twee dingen voor nodig:

-

- Buitenlanders die de schuld niet meer opkopen.

-

Inflatie binnenlands.

Als buitenlanders in paniek raken, stijgt de rente sterk. Daardoor kan de bubbel barsten. Maar Amerikanen denken:“Je kunt nergens anders heen. Misschien mag je mij niet, maar je hebt niemand anders.” Intern blijft het geloof bestaan: “Is er een probleem, dan gooi ik er geld tegenaan.” Waarom zouden ze veranderen? Het is een gratis lunch.

Het einde van het sprookje

Wat gebeurt er als hij barst?

Niemand weet het. Dit keer kan het een revolutie veroorzaken – vanwege de rijkdom. Deze monetaire bubbel heeft een kleine groep mensen heel rijk gemaakt. 10 procent van de mensen zorgt voor 50 procent van de consumptie. Jeff Bezos is onlangs in Venetië getrouwd. Hij heeft 50 miljoen dollar aan zijn bruiloft uitgegeven. Geen sprookjeshuwelijk, het zijn allebei hele oude mensen. Waarom sloven ze zich zo uit? Omdat ze het kunnen.

De wereldwijde bubbel

Er is veel te veel geld wereldwijd. Mensen kopen overal huizen. De grote vraag drijft de prijzen op. Betaalbaar wonen is een wereldwijd probleem. Huizen zijn een massaproduct – hoe kan het dat velen ze niet kunnen betalen? Dat betekent dat wanneer de bubbel in de VS barst de wereldwijde bubbel ook gaat barsten. Het goede nieuws: de prijzencrisis in rijke landen verdwijnt.

Het levensonderhoud wordt goedkoper. Maar de waarde van je eigendommen daalt. Het leven wordt makkelijker, maar je bent minder rijk dan je dacht.

Verheugt u zich op het barsten van de bubbel?

Het is iets waar we doorheen moeten. Zoals aan het eind van de jaren ’20 – The Great Gatsby. Hoe langer een bubbel voortduurt, hoe gevaarlijker hij wordt.

Na de bubbel

Kijk naar wat er gebeurde in Duitsland in de jaren dertig. Na het barsten van de bubbel hadden verschillende landen verschillende reacties. Sommigen gaven anderen de schuld – tot in het extreme. Er zullen ernstige politieke gevolgen zijn. Het enge is dat mensen soms een ander land de schuld zullen geven. China is de zondebok: “Wij zijn arm, omdat China ons geld heeft gestolen.” Als het zover is, is het een test voor iedereen.

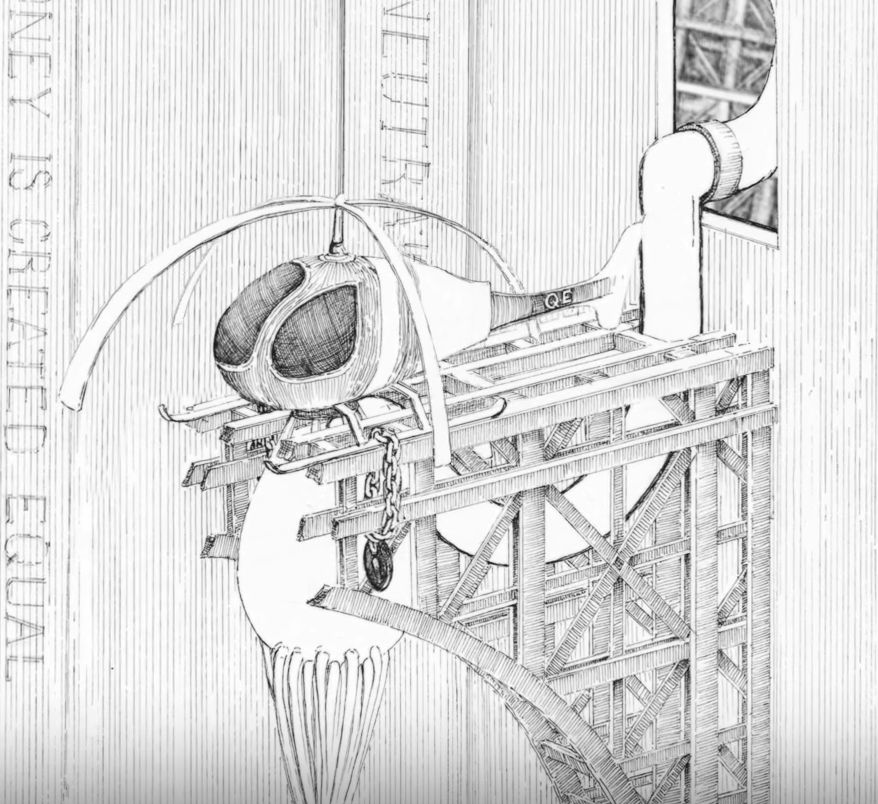

Stanislas Jourdan is the European Director of Positive Money, an association in charge of supporting research and promoting a conception of money capable of making the financial system more equitable, sustainable and democratic. After the Quantitative easing for the people project, the association notably promoted a form of helicopter currency based on a payment of 1000 euros to each European citizen (cf. references).

Stanislas Jourdan is the European Director of Positive Money, an association in charge of supporting research and promoting a conception of money capable of making the financial system more equitable, sustainable and democratic. After the Quantitative easing for the people project, the association notably promoted a form of helicopter currency based on a payment of 1000 euros to each European citizen (cf. references).

All over the world petitions are shared to ask for money. From temporal allowance during the Covid-crises to permanent Unconditional Basic Income.

All over the world petitions are shared to ask for money. From temporal allowance during the Covid-crises to permanent Unconditional Basic Income. For the European Citizens, a new Citizens’Initiative wil start on the 25th of september 2020. During one year European citizens can sign to persuade the EC to support countries with the implementation of an Unconditional Basic Income. The goal is 1 million signatures.

For the European Citizens, a new Citizens’Initiative wil start on the 25th of september 2020. During one year European citizens can sign to persuade the EC to support countries with the implementation of an Unconditional Basic Income. The goal is 1 million signatures.