2016 was marked with a series of successes in challenging the ECB’s strategy and bringing the discussion on monetary policy forward. Please find below 10 of the achievements we are most proud of. Continue reading “QE for People’s 10 steps forward in 2016”

Can helicopter money kick start the Eurozone?

With Eurozone growth still sluggish, should the European Central Bank (ECB) consider a radical option – like helicopter money?

ING senior economist Teunis Brosens explains, in this eZonomics video, that the ECB has already employed quantitative easing[1] and lowered interest rates below zero. But how effective these measures will be is unclear, he says.

Continue reading “Can helicopter money kick start the Eurozone?”

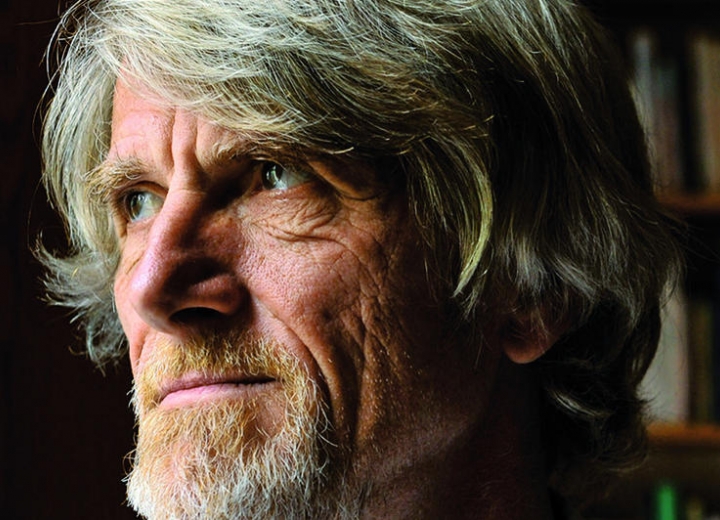

The Euro Dividend by Philippe van Parijs

Criticizing is easy. Making proposals is harder. Here is one, simple and radical, yet — I shall argue — reasonable and urgent.

Euro-dividend is how I shall call it. It consists of paying a modest basic income to every legal resident of the European Union, or at least of the subset of member states that either have adopted the Euro or are committed to doing so soon. This income provides each resident with a universal and unconditional floor that can be supplemented at will by labour income, capital income and social benefits. Its level can vary from country to country to track the cost of living, and it can be lower for the young and higher for the elderly. It is to be financed by the Value Added Tax. To fund a Euro-dividend averaging 200 Euros per month for all EU residents, one needs to tax the EU’s harmonized VAT base at a rate of about 20%, which amounts to close to 10% of the EU’s GDP. Continue reading “The Euro Dividend by Philippe van Parijs”

No Eurozone without Euro-dividend

The four characteristics that make the difference between the euro zone and the dollar zone and a concrete proposal to save the euro.

Abstract

The vulnerability of the European currency union is ultimately rooted in the extreme weakness of two major buffering mechanisms that have proved crucial to the sustainability of the currency union formed by the United States: inter-state mobility and inter-state solidarity. As little hope can reasonably be staked in increased mobility between member states of the European Union, it is of crucial importance to explore the way in which a far higher level of solidarity could be institutionalized between member states. After having considered and rejected a number of options, the paper ends up focusing on a universal euro-dividend paid to every resident of the European Union (or of the Eurozone) and funded exclusively or mainly by a Value Added Tax. Taking for illustrative purposes a monthly euro-dividend of 200 euros funded by a 20% EUwide VAT, it explores some of the key consequences of such a set up and the conditions of its political feasibility. Continue reading “No Eurozone without Euro-dividend”